Starting in 2025, every organisation in Ireland with more than 50 employees will be required to report their gender pay gap. While the legal requirements are clear, the process can be overwhelming if you’re going through it for the first time.

At HRLocker, we’ve completed this process ourselves. We’ve learned a lot along the way, so we wanted to share a practical, straightforward guide that goes beyond the rules to explain how to actually do it.

What is the Gender Pay Gap?

The gender pay gap is the difference in average hourly earnings between men and women across your organisation. It’s not the same as paying people unequally for the same job. Instead, it reflects how men and women are spread across different roles and levels.

If your leadership or sales teams are mostly men and your admin or support roles are mostly women, this will show up in the numbers. The goal is to highlight those patterns so organisations can address them where necessary.

Who Needs to Report?

Here’s how the reporting requirement has expanded:

- In 2022, companies with 250 or more employees were included

- In 2024, it applied to those with 150 or more

- In 2025, it includes every organisation with more than 50 employees

- You’ll need to select a snapshot date in June 2025. If you have 50 or more employees on that day, you need to publish a report within five months.

How to Prepare Step by Step

1. Pick Your Snapshot Date

This can be any day in June. We chose June 12 at HRLocker because it gave us some space to work with before the November deadline. Let your HR and Finance teams know early so they can plan.

2. Count Your Employees

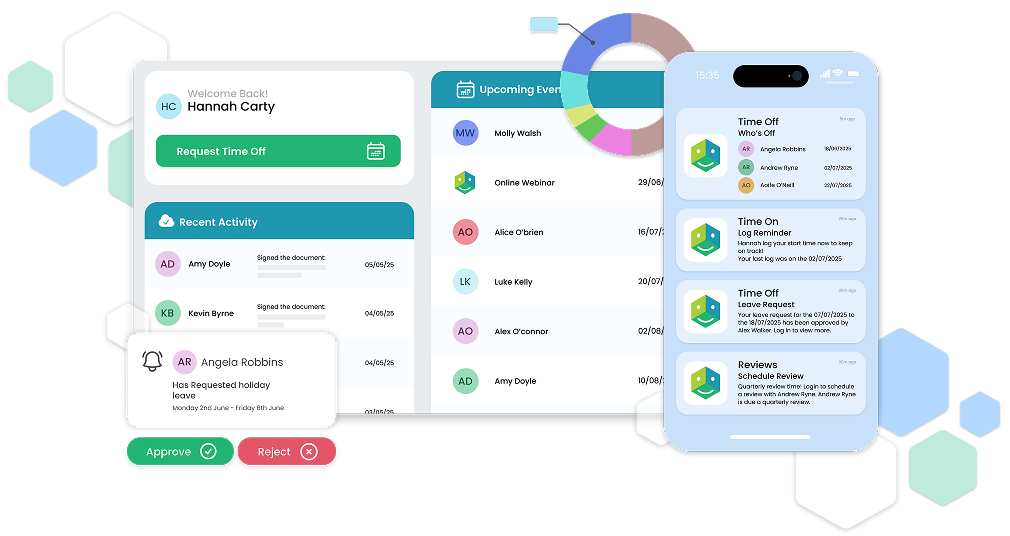

Include everyone with an employment contract. That means full-time, part-time, temporary, and remote staff on your Irish payroll. We used our HRLocker system to filter the data, which helped prevent mistakes and saved a lot of time.

3. Calculate the Required Metrics

You’ll need to report:

- Mean and median hourly pay gaps between men and women

- The same for part-time and temporary workers

- Bonus pay gaps and participation rates

- Proportion of employees receiving benefits in kind

- Gender representation across pay quartiles

We pulled data on pay, hours, and bonuses. Where information was missing or unclear, we worked with our Finance team to sort it out. Official guidance from gov.ie was very helpful for getting the calculations right.

4. Explain the Numbers

This is where you tell the story behind the figures. For example, our report showed that men were much more likely to receive bonuses. At first, that looked like a problem. But when we looked closer, we saw that our sales team, which was all male at the time, was the only team receiving bonuses.

This showed us the real issue was representation in our sales team. In response, we started using more inclusive job ads, promoting internal mobility, and creating mentorship opportunities to encourage better balance.

5. Publish the Report

The Department for Children, Disability and Equality is expected to launch an online portal for reporting in late 2025. You’ll need to upload your data there. You also have to publish the report on your organisation's website where both employees and the public can find it. It has to stay there for at least three years. We added ours to a compliance section on the HRLocker website.

6. Talk to Your Team

Don’t let people find out about your gender pay gap on social media. We held an all-hands meeting, then followed up with a summary and FAQ. Once everyone inside was informed, we published it externally. Think about what different groups in your organisation care about and tailor your message accordingly.

7. Review and Improve

After we published the report, we took some time to reflect. We looked at what helped us, what slowed us down, and what we could improve for next time. Having all our data in one place within HRLocker made a big difference. It made the process smoother and gave us more confidence in our results.

What Happens If You Don’t Report?

At the moment, there are no financial penalties for failing to report. However, the Irish Human Rights and Equality Commission can go to court to enforce compliance. Employees can also make complaints to the Workplace Relations Commission. More importantly, not reporting sends the wrong message about your commitment to fairness and transparency.

What’s Coming in 2026?

By June 2026, Ireland will need to comply with the EU Pay Transparency Directive. That will bring new requirements for job ads, salary transparency, and pay reporting. If you get the 2025 process right, you’ll already be building the systems you’ll need for what’s next.

In Summary

This process is more than a legal obligation. It’s a chance to understand your organisation better and make meaningful progress on equity.

Pick your snapshot date, start preparing your data, involve your teams early, and use your report as a tool for improvement.

If you’re looking for an HR platform that can help with the process, HRLocker is designed to support you at every step. We’re happy to walk you through how we handled it and what we learned.