Auto-Enrolment in Ireland

A significant change is on the horizon for employers in Ireland. The introduction of the Auto-Enrolment (AE) Retirement Savings System, set to launch on 1st January 2026, will transform how employees save for retirement. For HR Managers and business owners, understanding the new obligations is crucial to ensuring a smooth, compliant transition.

This new system, known as My Future Fund, is designed to ensure a larger share of the workforce has access to a private pension. For many employers, this will be a new process to manage. Preparing your business, adapting your payroll, and communicating with your team are essential steps to take now.

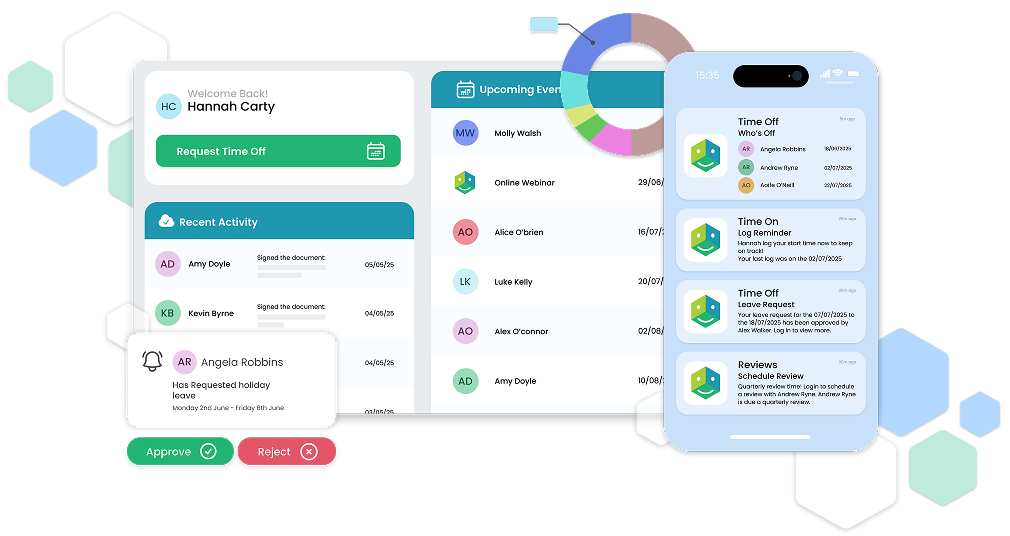

To help you navigate these changes, we are hosting a webinar covering everything you need to know.

Understanding Ireland's Auto-Enrolment System

The new auto-enrolment system will apply to employees who meet specific criteria. The National Automatic Enrolment Retirement Savings Authority (NAERSA) will be responsible for administering the scheme, but employers will play a vital role in its implementation.

Key aspects of the system include eligibility checks, contribution management, and payroll integration. Preparing for these responsibilities ahead of the January 2026 deadline will prevent compliance issues and streamline your HR processes.

Eligibility Criteria

One of the first things employers must understand is which employees are covered by the new mandate. NAERSA will determine eligibility based on the data submitted to Revenue; however, employers must be aware of the specific conditions.

An employee will be automatically enrolled if they meet all three of the following criteria:

- Age: 23-60 years old.

- Earnings: Earn over €20,000 per year across all employment.

- Pension Status: Not currently part of an existing occupational pension scheme.

Employees who do not meet these criteria, such as those earning less than €20,000 or outside the age range, may have the option to opt in voluntarily. Certain employment classes are also excluded.

Contribution Rates and Structure

A core component of the auto-enrolment system is the shared contribution model between the employee, the employer, and the State. Contributions are phased in over ten years, starting from 2026.

Here is the breakdown of the contribution rates:

| Timeframe | Employee | Employer | State Top-Up | Total |

| Years 1-3 (2026-2028) | 1.5% | 1.5% | 0.5% | 3.5% |

| Years 4-6 (2029-2031) | 3.0% | 3.0% | 1.0% | 7% |

| Years 7-9 (2032-2034) | 4.5% | 4.5% | 1.5% | 10.5% |

| Year 10+ (2035+) | 6.0% | 6.0% | 2.0% | 14.0% |

A key detail for employers is that contributions are based on gross earnings up to a cap of €80,000. Your payroll system must accurately calculate these matched contributions. The State's contribution is provided as a top-up, replacing traditional tax relief for the employee.

Adapting Your Payroll and HR Processes

The introduction of auto-enrolment will have a direct impact on your payroll function. NAERSA will use payroll data submitted to Revenue (PSR) to identify eligible employees and will issue an Auto-Enrolment Pension Notification (AEPN) to employers.

Your payroll software will need to:

- Receive and apply AEPNs.

- Accurately calculate employee and employer contributions.

- Report these contributions to NAERSA before the deadline on each pay date.

Beyond payroll, HR documentation will require updates. This includes creating an internal auto-enrolment policy, preparing an FAQ document for employees, and updating employment contracts.

Employee Opt-Outs and Suspensions

While participation is mandatory for the first six months for enrolled employees, provisions are in place for opting out and suspending contributions.

- Opt-Out: Employees can choose to opt out during a specific window in months seven and eight of their membership. Employee contributions will be refunded, but employer and State contributions will remain in their pot.

- Suspension: After the initial six months, employees can pause their contributions for a minimum of 1 year and a maximum of 2 years.

- Re-enrolment: Employees who opt out will be automatically re-enrolled into the system after two years if they still meet the eligibility criteria.

NAERSA will manage these processes and notify employers of any changes; however, HR teams must understand the timelines and communicate them effectively to staff.

Join Our Webinar to Learn More

Navigating the complexities of auto-enrolment requires preparation and a clear understanding of your obligations. To help your business get ready, HRLocker is hosting an essential webinar: "Auto-Enrolment in Ireland: What Employers Need to Know."

Join our experts on Thursday, 20th November at 11:00 AM for a detailed guide to the new system. We will cover:

- A complete overview of the "My Future Fund" scheme.

- In-depth explanation of eligibility criteria and contribution rates.

- The role of NAERSA and what it means for employers.

- Practical steps for adapting your payroll and HR systems.

- An employer readiness checklist to help you prepare for January 2026.

This is your opportunity to gain valuable insights and ask questions directly to our experts. Equip yourself with the knowledge to manage this transition with confidence.

Can't make the live session? Register anyway, and we will send you the recording to watch at your convenience.