IR35 is essentially a UK payroll tax for UK-based contractors. IR35 impacts very few Irish contracts as it's a UK law designed to stop workers in the UK's contracting industry from avoiding their full tax and National Insurance obligations.

IR35, first announced in 1999, was designed to tackle tax avoidance through what the UK government called the growing practice of 'disguised employment'. This is when a person works for a client in the same way as they would if they were an employee, but instead provides their service as if they are self-employed or via a limited company because the tax liability is lower than for employees.

IR35 became law in 2000, giving the UK's tax authority, HMRC, the power to tax some contractors as if they were employees. The rules have been updated significantly several times since then.

The 2021 update was designed to tackle non-compliance from employers, ensuring that contractors and employees pay similar tax. The main effect was that clients (not contractors) were made responsible for making IR35 decisions.

Before, contractors could self-certify their IR35 status, meaning they could slip through the net and avoid fair levels of taxation. With businesses increasingly relying on short-term contract work, it became more important than ever that companies have a system in place for managing and retaining contract workers.

What are the implications for firms that don’t comply?

The first thing businesses need to know is that a broad-brush approach to IR35 won’t cut it. HMRC advises that businesses should pay extra attention to their IR35 decisions and avoid tarring workers with the same employment status brush. Where a team of contractors may appear similar on the outside, the way they do business can differ enormously.

In 2020, 4.4 million people in the UK were registered as self-employed, in sectors as varied as construction, media, professional services, and sales—some work on a project-by-project basis, others, a 12-month retainer. While a freelance accountant may wish to invoice at an hourly rate, an architect could choose to charge a project fee.

With this level of role diversity within the contractor workforce, it’s no wonder categorising employment status is a laborious job. Fortunately, HMRC provided some case study examples to support decision-making.

Hypothetical contractor Vasilis is a risk management consultant for a pharmaceutical firm. He falls into IR35 because the business controls where he works. He’s unable to take on additional work due to his contract, and his role includes management responsibilities. This means he’s considered to be an employee under IR35.

Freelance web designer, Susan's employment status falls outside of IR35, so she’s responsible for handling her own tax. This is because she works for multiple clients, from a location of her choosing, and is paid for work completed (not by day).

Both Vasilis and Susan are service industry contractors, but their business models are quite different when you dig below the surface. It might seem tempting to lump them both into the same category, but this would be penalised by HMRC.

Even businesses with the most robust management strategy are likely to make mistakes when first dealing with IR35. What’s most important is that you can provide evidence of comprehensive processes and policies that guide IR35 decision-making within the business.

If businesses want to make use of contractor talent, they must have measures in place that ensure IR35 compliance. While fines and penalties are unfortunate, putting off top-tier contract talent with poor management skills could be more damaging to your business in the long run.

The benefits of working with contractors in modern times are that the needs of businesses change quickly. Having a flexible workforce available on a project-by-project basis is invaluable if companies don’t have the capacity to take on additional employees.

What can companies do to cultivate better contractor management?

With every contractor you hire comes a mountain of paperwork (or a shared drive full of documents).

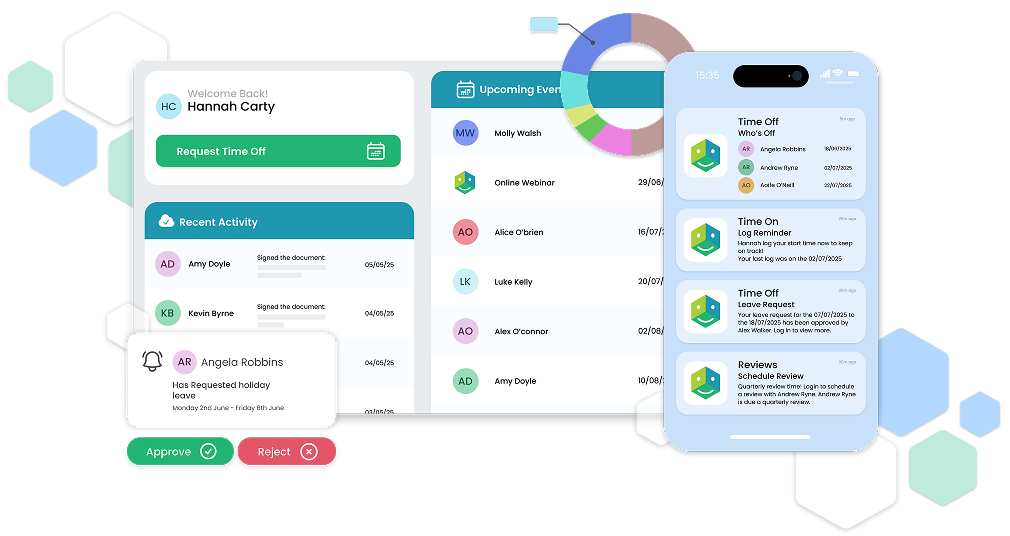

Today, HR platforms provide a central database to manage all workers, no matter their employment status. Centralising this information improves visibility and makes it easier to access for other departments. No doubt there’ll be temporary workers you want to hire in the future, so having their profile and documents to hand will save some admin in the long run. HR teams may not work with every contractor hired, but other areas of the business might need to know the status of their employment.

With good policies in place, HR teams can utilise automation to ensure their contractors are always up to date with the latest details on their employment status. Clear, frequent communication between HR and contractors helps to consolidate the rules and align contract staff with internal policies.

The IR35 rules apply on a case-by-case basis, which means contractor management requires regular maintenance, even for longstanding relationships. Just make sure you define your protocols for determining employment status, so contractors know what to expect, and your business knows where they stand on compliance.

Having a framework in place will enable you to spot discrepancies and fine-tune your procedures so that you can avoid non-compliance. Otherwise, HMRC might ask you to cough up the tax and national insurance payments that should have been made. And those costs soon stack up.

To many businesses, IR35 might seem like another burden they have to bear in the aftermath of Covid-19. But as more people embrace self-employment and the flexibility that comes with it, companies could lose access to unique talents and skills if they’re unable to properly support the contractor ecosystem. It’s time to embrace the structured approach to contractor management, so everyone can reap the rewards of increasing employment flexibility.