Audit‑ready reporting often gets dismissed as something only large corporations need. But in Ireland, SMEs face the same compliance risks (think Workplace Relations Commission (WRC) inspections, GDPR audits, and new obligations like Gender Pay Gap reporting - mandatory for employers with 50+ staff since June 2025).

As our Irish SME HR Report 2025 found, not having audit-ready reporting in place is a widespread issue. If you fall into this bracket, you’re not alone. Three-quarters (74%) of Irish SMEs said they don’t feel confident that they could pass an unannounced WRC inspection if it happened tomorrow.

Without proper preparation and systems, businesses of all sizes can be caught off guard, leaving them exposed to fines, disputes, and reputational damage.

The Myth: “Being Audit‑Ready Only Matters to Big Companies”

Many SME leaders we’ve spoken to assume they’re too small to attract regulatory attention. In reality, inspectors don’t discriminate by size. The WRC regularly audits SMEs, and GDPR applies to any organisation handling employee data. Even issues like payroll errors or missing written terms can trigger claims or inspections.

The Risks of Not Being Audit‑Ready

Not being audit‑ready isn’t just about missing a few boxes on an inspector’s checklist. It leaves your business exposed to unexpected financial shocks, undermines employee confidence in how things are managed, and signals to stakeholders that governance isn’t a priority.

Here’s what can go wrong if you’re not audit‑ready:

- GDPR fines: If employee data isn’t stored securely or retention rules aren’t followed, you could face penalties of up to €20 million or 4% of global turnover under GDPR. For most small businesses, even a fraction of that would be devastating.

- WRC penalties: Depending on the legislation breached, compensation awards or fines can arise, and failures such as missing records or written terms can lead to multiple findings against an employer.

- Gender Pay Gap reporting: Since June 2025, Irish employers with 50+ staff must publish annual gender pay gap data. Failing to report, or publishing inaccurate figures, can lead to enforcement action and reputational fallout.

- Payroll disputes: If hours, breaks, or leave aren’t tracked properly under the Organisation of Working Time Act 1997, employees can challenge payroll records. That means back payments, legal claims, and damaged trust could all come into play.

- Reputational damage: Beyond fines, the bigger risk is credibility. Word spreads quickly when a company is penalised for non‑compliance. It can affect recruitment, retention, and even customer confidence.

What Audit‑Ready Reporting Looks Like

Audit-ready reporting is about being prepared for an inspection every day, not scrabbling when someone calls.

Here’s what being audit-ready looks like in practice:

- Contracts and core terms: Every employee has a signed contract, with the core terms issued within five days of starting, as required by the Employment (Miscellaneous Provisions) Act 2018. Audit‑ready means you can pull up those contracts instantly, not spend hours digging through filing cabinets.

- Working time records: Hours, breaks, and leave are all tracked under the Organisation of Working Time Act 1997. Audit‑ready means you’ve got clear logs (whether that’s digital or paper) that show employees are getting their entitlements.

- Leave entitlements: Sick pay, parental leave, and newer entitlements like domestic violence leave must be properly recorded. Audit‑ready means you can show who has taken what leave, when, and how it was approved when asked.

- Policy acknowledgements: It’s not enough to have policies written—you need proof your staff have received and understood them. Audit‑ready means you’ve got signed acknowledgements or digital confirmations stored safely and that they’re easily retrievable.

- GDPR compliance logs: Under GDPR, you need to show how you handle employee data, which includes things like retention schedules, access requests, and security measures. Audit‑ready means you can demonstrate not just that you say you’re compliant, but that you’ve got the records to prove it.

How SMEs Can Get Audit-Ready

Getting audit‑ready might sound daunting, but it’s really about building simple habits and using the right tools.

Here’s how SMEs can get audit-ready:

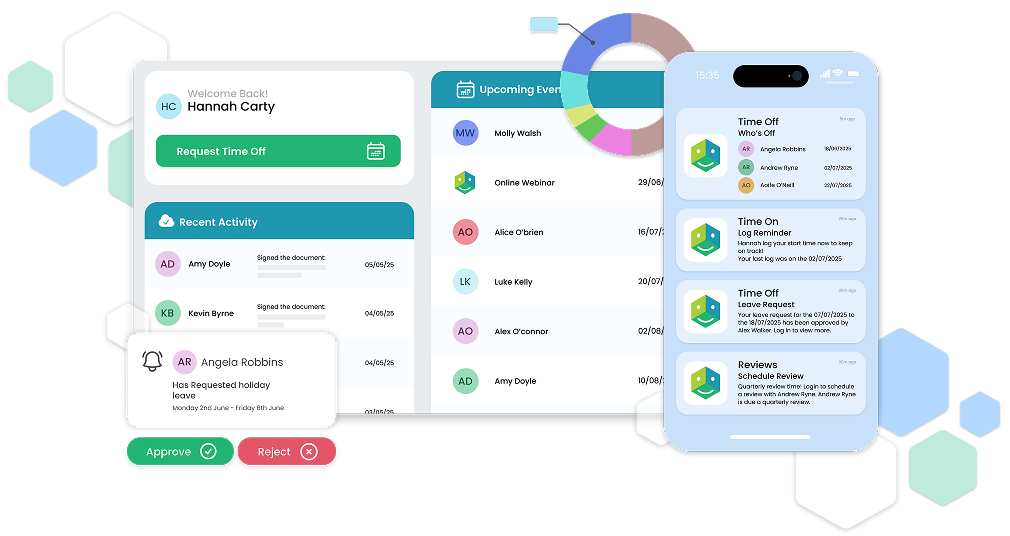

- Centralise your records: Instead of scattering contracts, timesheets, and policy acknowledgements across folders and inboxes, bring them together in one secure place. Tools like HRLocker’s Employee Database make this simple, giving you one hub for contracts, timesheets, and right‑to‑work proofs.

- Automate reminders: Compliance deadlines creep up quickly—contract reviews, training renewals, policy updates, and so much more. HRLocker’s automated renewal reminders give you timely nudges when needed, so you’re not relying on sticky notes or memory, and nothing slips through the cracks.

- At-a-glance visibility: Boards and leaders don’t want raw data; they want clarity. HRLocker reporting dashboards provide a clear view of compliance metrics - like leave balances, training completion, or policy acknowledgements - making it easy to show you’re on top of things.

- Protect sensitive data: HR files contain some of the most personal information in your business. Encrypt them, restrict access to authorised staff, and set retention rules so you’re not holding onto data longer than necessary.

- Schedule your own audit: Don’t wait for the WRC or a GDPR officer to point out gaps. Run an internal HR audit once a year. Walk through your records, policies, and processes as if you were the inspector. It’s a proactive way to catch issues before they become problems.

Audit‑ready reporting doesn’t mean being perfect—it means being prepared. By centralising, automating, and protecting your records, you can make compliance part of everyday practice rather than a last‑minute scramble when the stakes are at their highest.

The Payoff

Being audit‑ready isn’t just about avoiding fines - it builds trust with employees, reassures boards, and shows regulators and investors that you take compliance seriously.

With evolving legislation and closer scrutiny, audit‑ready reporting is no longer optional for Irish SMEs; it’s the difference between faltering under pressure and confidently producing the right records at the right time.

By embracing digital tools and structured processes, even the smallest business can stay compliant, reduce risk, and focus on what really matters - its people!

Download our FREE HR Health Checklist and make compliance one less thing to worry about this year!