Payroll reporting in Ireland is subject to a unique set of regulations and requirements that HR managers must be well-versed in to ensure compliance and accurate compensation for employees. Here’s a concise guide on what HR managers need to know about payroll reporting in the Emerald Isle.

Understanding the PAYE Tax System

Ireland operates a pay-as-you-earn (PAYE) system, where employers deduct income tax and social insurance contributions from employee wages. HR managers must ensure that payroll systems are set up to calculate and deduct these taxes correctly.

Compliance with Revenue Rules

The Irish Revenue is responsible for tax collection. HR managers need to stay updated on the latest Revenue rules and guidelines, as non-compliance can lead to penalties and legal issues.

Tax Credits and Bands

Ireland’s tax system includes tax credits and bands. HR managers must be familiar with these to calculate employees’ tax liabilities accurately.

USC (Universal Social Charge)

USC is a tax on income and must be deducted along with income tax. HR managers need to understand the USC rates and exemptions.

PRSI (Pay Related Social Insurance)

PRSI contributions fund social welfare benefits. HR managers must ensure the correct PRSI class for each employee, as different classes have different contribution rates.

P45 and P60 Forms

HR managers are responsible for providing employees with P45 forms when they leave employment and P60 forms at the end of the tax year. These forms summarise tax paid and must be accurate and timely.

Real-time Reporting (RTR)

Ireland operates a real-time reporting system. HR managers should ensure that payroll reporting aligns with this system to provide accurate data to the Revenue.

Employee Benefits and Deductions

HR managers should accurately track and report employee benefits and deductions, including pension contributions and other voluntary deductions.

Holiday Pay and Public Holidays

HR managers must consider holiday pay, especially when public holidays affect work schedules. Understanding how to calculate and report holiday pay is essential.

Record Keeping

Irish law requires employers to keep payroll records for six years. HR managers should maintain and organise these records for potential audits.

Data Protection

HR managers need to ensure that payroll data is protected and processed in compliance with the General Data Protection Regulation (GDPR).

Employee Communication

Clear communication with employees regarding payroll, including tax deductions and pay slips, is essential to address any questions or concerns promptly.

Payroll Software

Investing in reliable payroll software that is up-to-date with Irish regulations can significantly simplify the reporting process and reduce errors.

Outsourcing Options

For some companies, outsourcing payroll to experts can be a practical and cost-effective solution, ensuring compliance and accuracy.

In Ireland, HR managers play a pivotal role in maintaining a deep understanding of the country’s payroll intricacies. Staying up-to-date on tax regulations, compliance requirements, and effective payroll management practices is vital for ensuring a seamless and precise payroll process.

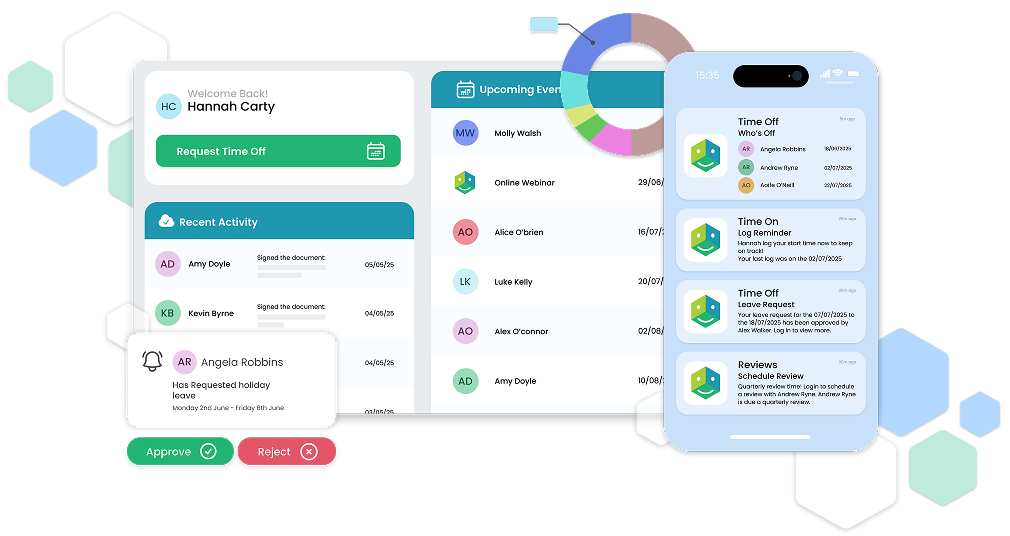

Managing employee payroll can be a complex task, especially when dealing with a diverse workforce featuring various work patterns and compensation structures. HRLocker’s Payroll Management Reports step in as a reliable solution. These reports offer a seamless way to track employee hours and payments, thus enhancing the accuracy and efficiency of your payroll process, all while being tailored to your specific organisational needs.